33+ Mortgage loan estimate calculator

Refinancing an existing home loan or investing in property RAMS mortgage calculators can give you an estimate of what your repayments could be based on your home loan amount your loan type and the. FICO Loan Savings Calculator to double-check.

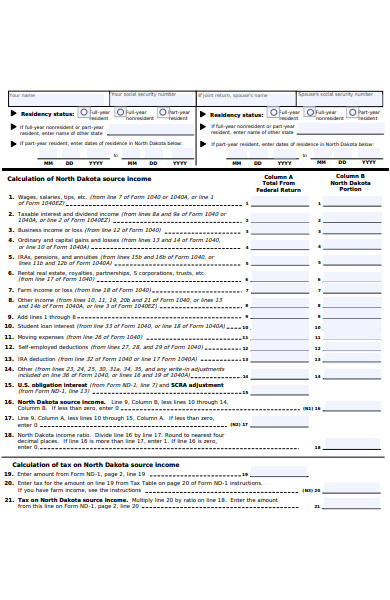

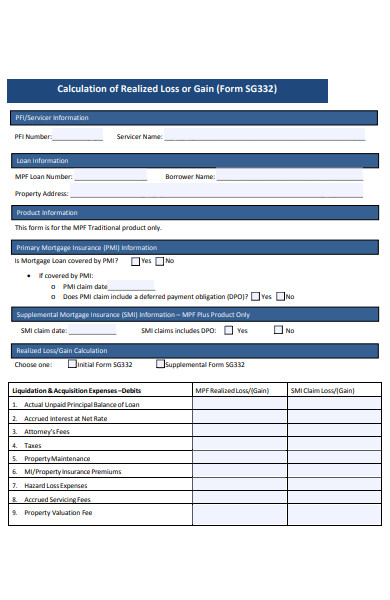

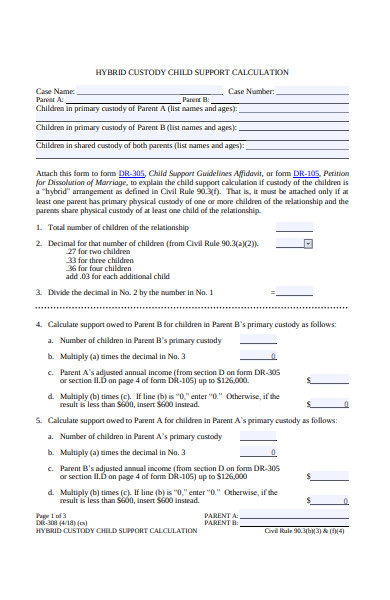

Free 31 Calculation Forms In Pdf Ms Word

The house must also be bought from a builder recognized by the program.

. Use RAMS free calculator to estimate what your repayments could be. Results of the mortgage affordability estimateprequalification are guidelines. If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000.

2836 are historical mortgage industry standers which are. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. Loan amountthe amount borrowed from a lender or bank.

Please be aware that this is only an indication of how much you could borrow. These are also the basic components of a mortgage calculator. Costs rose in the third quarter of 2020 over a cost of 6566 in the second quarter of 2020 due to increased spending on hiring personnel to service unusually high demand caused by record low mortgage rates.

This is up from 7217 in the same quarter of 2019. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan.

Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to.

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. In a mortgage this amounts to the purchase price minus any down payment. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value.

Get in touch with our home loan specialists all across Australia. You can use our biweekly mortgage calculator to estimate how much you can save. Everything that a homebuyer needs to get pre-approved for a mortgage loan.

To estimate an affordable amount. Total of 360 Mortgage Payments. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Fixed Monthly Payment Amount. Meet required mortgage repayments and default on your loan. We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees.

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. Check what you could afford to repay on a home loan with our Affordability Calculator or estimate how much you could borrow with our Maximum Loan Calculator. Check out the webs best free mortgage calculator to save money on your home loan today.

You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the. Page document called a loan estimate within three business days.

For additional information about or to do calculations involving mortgages or auto loans please visit the Mortgage Calculator or Auto Loan Calculator. The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your. Our calculator includes amoritization tables bi-weekly savings.

The equity loan scheme finances the purchase of newly built houses. The estimate is not an application for credit and results do not guarantee loan approval or denial. In Q3 2020 mortgage lenders had a per-loan expense of 7452.

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

33 Free Finance Printables

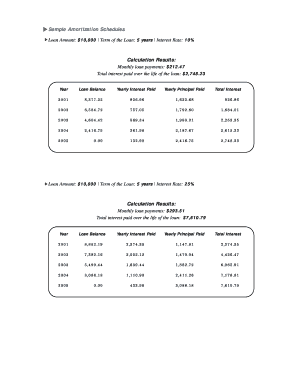

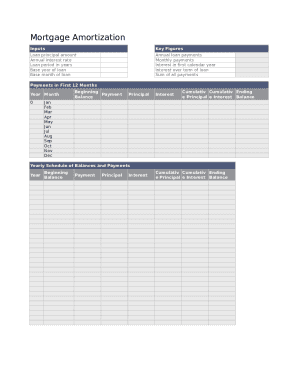

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

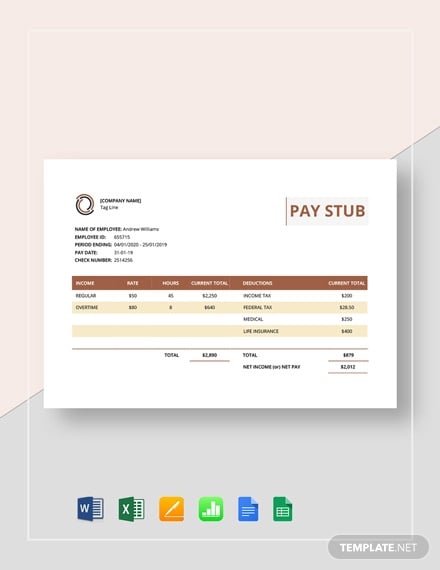

33 Stub Templates In Pdf Free Premium Templates

Kenny Idstein Loandepot

33 Fake Transcripts College Templates Collection Free Download Templates Study High School Transcript Homeschool Transcripts Homeschool Schedule Template

Kenny Idstein Loandepot

Free 9 Property Investment Proposal Samples And Templates In Pdf Ms Word Pages Google Docs

33 Free Finance Printables

Kenny Idstein Loandepot

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Legacy Cab 3033r 33 Hp Tractor Package Special

Free 31 Calculation Forms In Pdf Ms Word

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Free 31 Calculation Forms In Pdf Ms Word

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

Free Simple Loan Agreement Template Pdf 3 Page S Contract Template Statement Template Contract Agreement